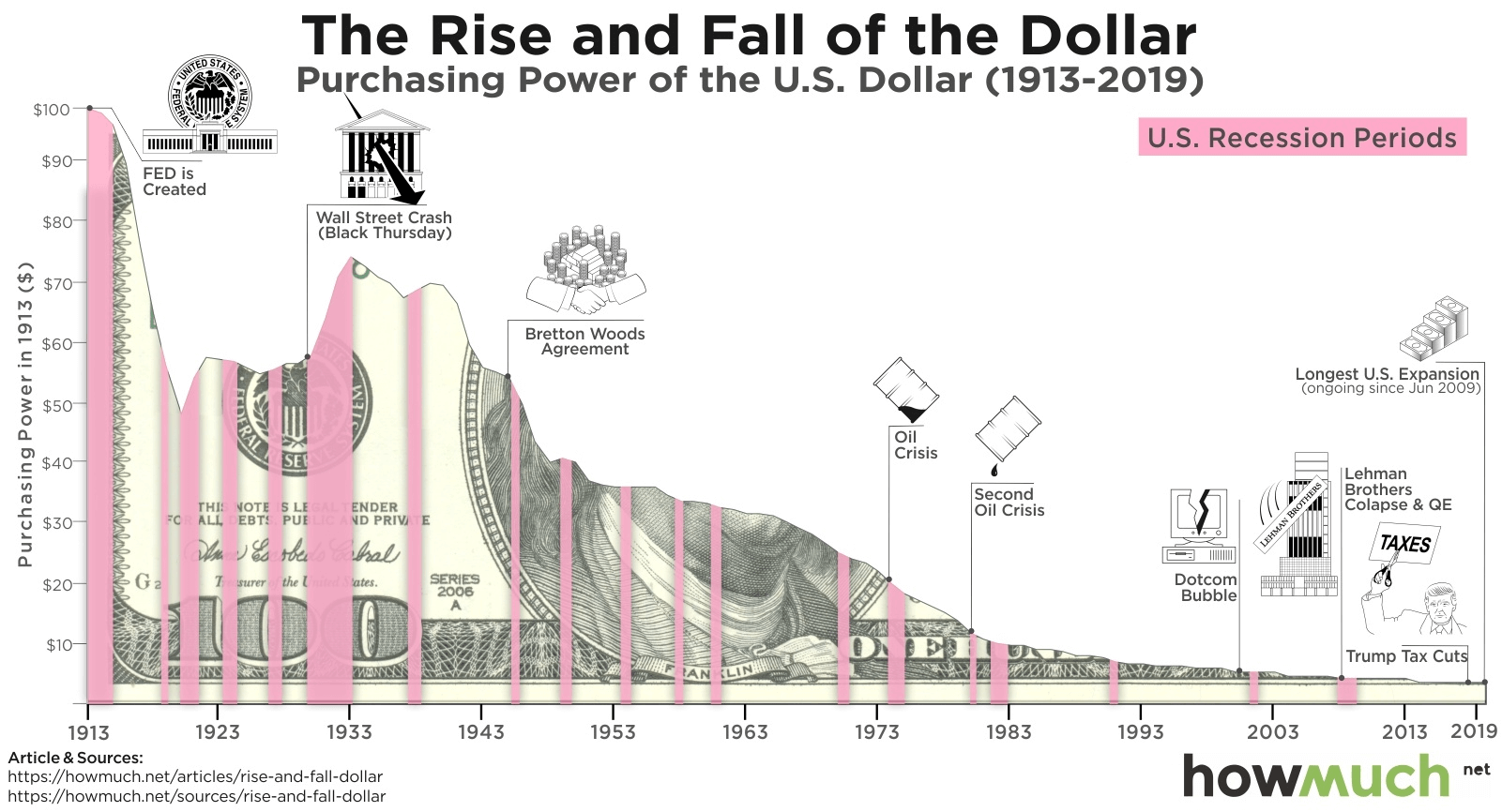

Inflation is a term that often raises eyebrows and causes concern for investors. As prices rise, the value of money diminishes, eroding purchasing power. Luckily, real estate is widely recognized as one of the best inflation-protected assets. In this BitBrick we lay out how real estate acts as an inflation hedge so those getting started in real estate investing can set themselves up for long-term financial success. Moreover, we'll explain how ArieaCoin brings a modern twist to traditional real estate investing, making it even more accessible and effective as an inflation hedge.

Real estate’s unique characteristics make it a powerful shield against inflation. Property values tend to rise in response to increasing costs of construction materials, labor, and land. This appreciation ensures that real estate assets not only preserve wealth but also grow in value over time. For investors, this means owning property can safeguard against the eroding effects of inflation on their purchasing power.

Another advantage lies in real estate's physical nature. During periods of high inflation, homeowners often make improvements to their properties. The goal is to make them a more pleasant place to live and entertain as the broader economy makes it more difficult to go out. Unlike stocks or bonds, real estate allows the homeowner to enjoy these investments day after day providing a sense of stability and security during uncertain economic times. In short, real estate's real-world utility makes it a reliable store of wealth.

For beginners, entering the world of real estate may seem daunting. With the right approach however, it can be an incredibly rewarding venture. Start by setting clear investment goals. Defining your objectives will help shape your investment strategy and guide your decisions.

Researching the market is crucial. Look for locations with strong economic fundamentals, such as growing populations, vibrant job markets, and ongoing infrastructure development. These factors often indicate areas where property values are likely to rise. Starting small can be a practical way to build confidence and experience. This is where investing in ArieaCoin really makes dollars and cents. Technology has transformed the way we invest in real estate. Digital platforms, like ArieaCoin, allow investors to invest in high-quality properties without the need for significant capital.

ArieaCoin combines the stability of real estate with the flexibility and innovation of real world asset tokenization technology. By leveraging this hybrid approach, ArieaCoin offers unique advantages that enhance real estate’s role as an inflation hedge opening the door for a broader audience to benefit from the inflation-protected nature of real estate.

Another challenge facing real estate investors is its lack of liquidity. Properties can take months to sell, and accessing funds tied up in real estate is not always straightforward. ArieaCoin solves this problem by offering a liquid marketplace where investors can trade their coins with ease. This innovation ensures you can access your investment when needed, providing flexibility that traditional real estate lacks.

Diversification is another key benefit. ArieaCoin allows you to spread your investments across multiple properties in different locations, enabling a more balanced and resilient portfolio. By participating in various property markets, you can take advantage of unique economic trends and opportunities in diverse regions. This not only reduces the risks associated with local market fluctuations but also enhances the potential for stable, long-term returns. For those new to real estate investing, this level of transparency can ease concerns and create a more confident investing experience.

Best of all, the value of ArieaCoin is directly tied to real estate assets, which naturally appreciate with inflation. By combining traditional real estate’s stability with the cutting edge innovatin of real world asset tokenization, ArieaCoin creates an investment opportunity that is not only modern and reliable but also designed to thrive in inflationary environments. It offers an accessible way to tap into the enduring strength of real estate without the barriers that typically accompany property ownership.

Inflation can have a detrimental impact on traditional investments like cash and bonds, but real estate stands out as a reliable hedge. Tangible assets like real estate retain their value over time, even as inflation rises. This makes them an essential component of any diversified portfolio. Rental properties, in particular, provide a consistent income stream that can be adjusted to match inflation, ensuring that investors maintain their purchasing power. Additionally, real estate’s long-term appreciation provides a reliable way to grow wealth, making it a cornerstone of inflation-resistant investing.

For beginners, starting small and leveraging modern tools are key steps. With ArieaCoin, you gain access to a diversified, liquid, and transparent portfolio of real estate assets. This modern approach ensures that your investments are not only protected from inflation but are also positioned for growth in the years to come.

With inflation rates climbing globally, there has never been a better time to invest in real estate. Platforms like ArieaCoin are transforming the investment landscape, making it easier than ever to participate in this inflation-protected asset class. By combining the best aspects of traditional real estate with cutting-edge technology, ArieaCoin empowers investors to protect and grow their wealth in an increasingly uncertain economic environment.

Real estate remains one of the most reliable inflation-protected asset classes. By understanding its unique advantages and leveraging innovative tools like ArieaCoin, you can hedge against inflation effectively while building a solid foundation for long-term financial security. For those getting started in real estate investing, now is the time to take action. Explore the opportunities that ArieaCoin offers and discover how you can benefit from this powerful combination of traditional stability and modern innovation. Investing in real estate doesn’t just protect you from inflation—it sets you on the path to lasting wealth.