The Autonomous Real estate Investment Evaluation Algorithm (ARIEA) merges principles from bioinformatics with the fundamentals of sound real estate investing. By applying the biological laws of population genetics over a vast library of market transactions, Ariea creates a robust market simulation. The premise is that these scientific principles, when applied to real estate economics, can enhance the algorithm’s ability to produce more accurate, insightful results.

The true measure of Ariea’s success was a double-blind experiment. A fully trained Millennial Realty & Investments Broker in Charge, relying solely on Ariea, successfully brokered and closed a deal for an investment property in an unfamiliar market with a cash client he had never met in a market he had never worked. During the validation, the client communicated only through a third-party intermediary to whom they briefly outlined the financial parameters of the investment criteria.

The test was declared successful when Ariea’s automated valuation model (AVM) delivered a property that precisely matched the client’s criteria, closing without concessions in re-trades or broker commissions.

ArieaCoin posits that while the real estate industry is evolving with the rise of sophisticated Automated Valuation Models (AVMs), an overreliance on these algorithms could expose financial services and local real estate markets to systematic vulnerabilities. As AVMs become more widely used, the risk of market imbalances grows when these tools are misinterpreted as the sole measure of property value.

Our central hypothesis is that real estate operates more as a biological system than a purely financial one. The natural limits, feedback loops, and governing laws of biological systems provide a more fundamental assessment of a property’s net inherent value than conventional financial metrics typically employed by commercial AVMs. Essentially, while AVMs generate useful financial data, this data merely outlines the deeper principles of value rooted in biological dynamics.

The purpose of this experiment was twofold. First, to validate the Ariea AVM’s ability to scale beyond its home market and successfully operate in expansion markets. Second, to evaluate the presence of primitive AI within the Ariea AVM's biologically inspired algorithms, a significant step towards our goal of large-scale deployment.

The experiment employed a double-blind format, ensuring that all parties were unaware of being part of a test. Conducted in the Charlotte, North Carolina market, the Broker in Charge (BIC) and the Ariea AVM had no prior experience in locating investment properties in this region.

To establish a positive control, a property at 11208 Presidio Drive in Ariea's home market was selected. Ariea's AVM identified this property, which was then put under contract. The BIC, using Ariea’s recommended financial metrics, reviewed all the financial details to confirm their accuracy and reliability. The BIC led all negotiations based solely on Ariea’s data-driven financial recommendations.

To safeguard the client, experienced Millennial Realty & Investment Brokers with deep knowledge of both the home and test markets supervised the experiment. This ensured the client was not exposed to undue risk. A comprehensive briefing was conducted on-site at the start of the experiment, with client consent obtained. As a further precaution, conducting the experiment within the client’s home market acted as a failsafe. All necessary disclosures, including North Carolina’s Working with Real Estate Agents brochure and relevant agency forms, were gathered per Millennial Realty & Investment's best practices.

The BIC and the client had never met or worked together previously. They communicated through a third-party intermediary and participated in a single one-hour teleconference, during which Ariea was calibrated to align with the client’s financial goals. This discussion occurred after the positive control property was placed under contract but before entering the test contract.

For the test property, the BIC conducted negotiations sight unseen—without reviewing any photos or MLS documentation—relying exclusively on Ariea’s recommended financial metrics. Success was defined by the test property meeting the client’s individual financial criteria within a 5% margin of error, and financial metrics aligned closely enough for the client to close on the transaction.

The insights gained from this blind test were used to further calibrate the Ariea AVM. Once final adjustments were made, a third property in the home market was successfully identified and closed with zero seller concessions or reductions in broker commissions. This process served as a Koch Postulate-style validation of the Ariea AVM’s effectiveness.

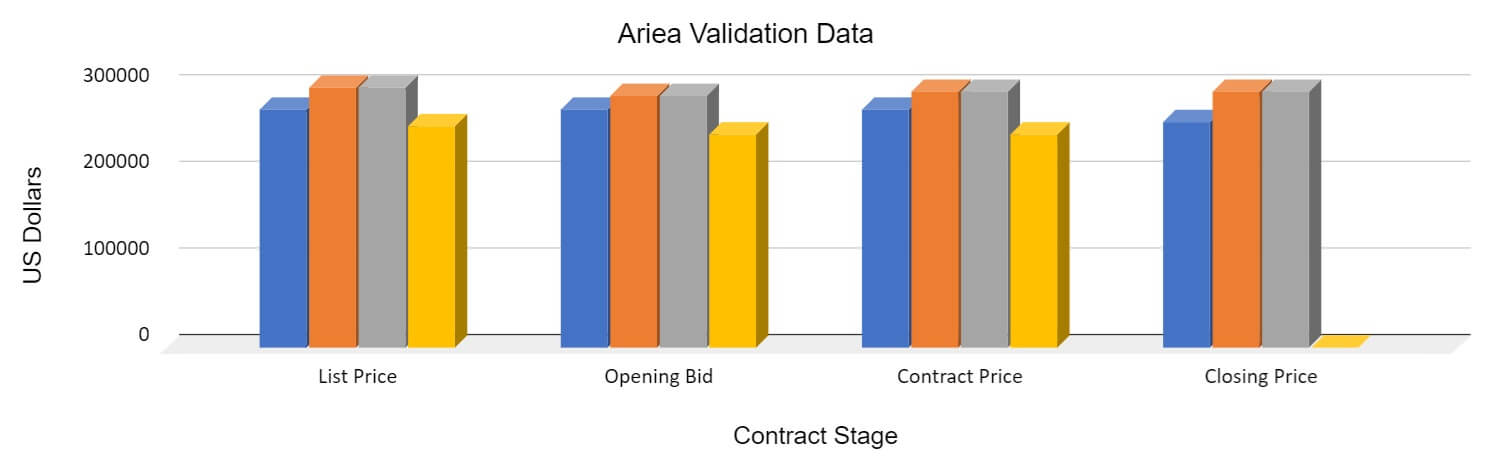

Ariea Validation Data: Figure represents the critical price points of each of the four contracted properties at each of the critical price stages of an investment real estate closing. Note property four was terminated upon initial broker walk due to several foundational problems providing successful negative control. This terminated property provides successful procedural negative control.

The results from the double-blind study demonstrated the efficacy of the Ariea AVM in real-world applications. The algorithm’s fair market value assessment for the test property was $341,313, closely aligning with the client’s onsite valuation of $339,000. This discrepancy represents a 0.6% positive error, which is well within the acceptable 5% margin of error established for accurate valuations in real estate.

This property was classified as a "noiseless rental", characterized by its ability to generate positive cash flow in both leveraged and unleveraged scenarios. Under typical loan structures, the property exhibited strong performance metrics. Specifically, in a fully leveraged position, it demonstrated the capacity to cash flow effectively, indicating a solid investment opportunity.

In the unleveraged scenario, the calculated cash flow was 5.82%, slightly below the target average of 6%. This resulted in a 3% negative error, again remaining well within the acceptable 5% margin. Despite this minor deviation from the target, the client recognized the property's overall financial metrics as favorable. They assessed that the potential returns aligned with their investment strategy and financial goals.

As a result of these findings, the client confidently decided to proceed to closing. The successful execution of this transaction not only validated Ariea's AVM accuracy and reliability but also reinforced its application in real estate investment decision-making. This outcome signifies a successful conclusion to the double-blind test, demonstrating that Ariea's AVM can provide actionable insights for investors navigating complex real estate markets.

The validation experiment for the Ariea Automated Valuation Model (AVM) was a resounding success. Not only did Ariea successfully identify an investment property in a new market that met the client’s specific needs, but it also revealed evidence of a primitive artificial intelligence artifact within its algorithms.

In preparation for the initial broker walk, the Broker in Charge (BIC) verified Ariea's investment calculations using the Millennial Realty & Investments rental investment calculator. This manual verification highlighted that Ariea initially utilized an incorrect heated living area value, leading to an anticipated monthly rent of $3,250 instead of the accurate figure of $2,650 determined later by the BIC.

In the BIC's extensive experience, an annual rental income discrepancy of approximately 19% typically disrupts investment calculations and jeopardizes the deal. However, Ariea's internal checks and balances corrected for this error and integrated a robust defensive hedge into its financial recommendations to the BIC. As structured, the deal offers around 6% annual cash-on-cash return with the potential for positive cash flow at 100% loan-to-value (LTV) and 7% annual percentage yield (APY). The client could feasibly purchase the property outright, refinance it to recover their cash (plus additional funds), and achieve an infinite return on investment (ROI), effectively creating a what Millennial Realty & Investment dubs a "noiseless profit engine."

Despite an investigation into this artifact within the base code, the developer could not precisely determine how Ariea executed the correction. Our leading theory suggests that it may be a combinatorial artifact arising from the distinct weights and measures Ariea aggregates to inform its valuations. This points to primitive evidence of artificial intelligence at work.

The Ariea AVM performed as anticipated, enabling the Millennial Realty & Investments BIC to successfully close three transactions concurrently using these same basic paramters outperforming the Client's stable of other real estate brokers. The experiment was a success and the Areia AVM fully validated for production operations and coin minting.

The ARIEA Automated Valuation Model (AVM) successfully met all criteria for technical validation. Ariea has proven its capability to assist Millennial Realty & Investment brokers in closing profitable transactions on behalf of clients, all while maintaining ethical standards and avoiding predatory practices. The Ariea model demonstrated a higher frequency of successful closings and an increased probability of success compared to existing AVM methods throughout the value chain.

This achievement marks a significant milestone, indicating the Ariea AVM is ready to transition into production deployment. This transition not only enhances the potential for innovative real estate solutions like ArieaCoin but underscores Ariea’s commitment to fostering a sustainable and effective real estate investment environment.