The world of cryptocurrency has often been criticized for its lack of inherent value, its reliance on speculative markets, and its notorious volatility. Investors searching for stability in this space often look toward assets backed by real-world value. ArieaCoin breaks new ground by offering a digital currency directly anchored to real estate values. What sets ArieaCoin apart is the proprietary Automated Valuation Model (AVM), Ariea, which powers the currency and links it to the tangible market value of residential properties.

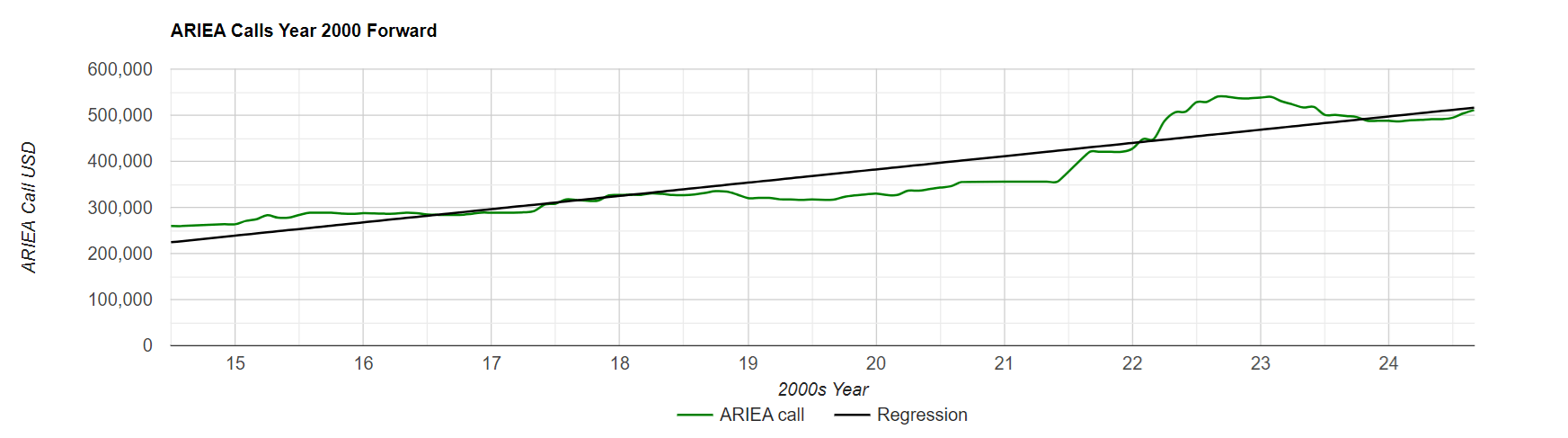

In this article we delve into how Ariea assigns accurate property prices, cementing ArieaCoin’s position as a stable and trustworthy cryptocurrency. We’ll discuss the core principles behind ArieaCoin, how the AVM mimics the real estate appraisal process, and how its market performance has demonstrated unprecedented accuracy. With over 419 thousand properties presenting data and over 236 million valuations established, Ariea boasts a 0.4% median error rate. Ariea sets a new standard for automated valuation models. We'll also explore the broader implications for real estate investment, cryptocurrency, and the use of comparative market analysis (CMA) in a digital age.

Cryptocurrency as a concept revolutionized how people think about money and financial systems. However, its rapid rise has often come with unpredictable fluctuations in value, primarily due to speculation. ArieaCoin addresses this fundamental issue by anchoring its value to an established and relatively stable asset class: real estate. This is made possible through the Ariea AVM, which mirrors the valuation processes used by real estate brokers and appraisers, ensuring that each coin is tied to the actual value of residential properties.

By using real-world data and advanced valuation algorithms, ArieaCoin offers both transparency and stability in an industry where such characteristics are rare. Unlike traditional cryptocurrencies, ArieaCoin has tangible, market-backed value. Investors can see how the valuation of each coin is derived from the real estate market and feel confident in the inherent worth of their holdings.

ArieaCoin functions similarly to other cryptocurrencies, with one critical difference: each ArieaCoin is backed by a real-world property value. To achieve this, the Ariea AVM evaluates properties based on the same principles that guide real estate professionals when conducting comparative market analysis (CMA). However, unlike manual appraisals, Ariea’s AVM can process hundreds of thousands of properties and millions of valuations at a scale and speed no human appraiser can match.

- Real Estate-Backed Stability: Each ArieaCoin represents a fraction of the value of real residential properties, reducing the volatility typically seen in cryptocurrencies.

- Automated Valuation Model (AVM): Ariea’s proprietary AVM assesses real-world properties, providing transparency and consistency in how property values are calculated.

- Comprehensive Coverage: Ariea has successfully evaluated over 419,000 properties and successfully called over 236 million valuations with a median error rate of just 0.4%. This makes it one of the most accurate AVMs in the real estate and cryptocurrency space.

Let’s explore how Ariea achieves this level of precision.

Real estate brokers and appraisers rely on comparative market analysis (CMA) to determine property values. Ariea’s AVM mimics this process, using a combination of historical sales data, property characteristics, and location-based data to evaluate properties. However, while a human appraiser might assess a handful of properties per day, Ariea’s AVM processes data on a much larger scale, ensuring its output remains current and consistent.

- 419,000 Properties Evaluated: Ariea’s AVM has provided accurate valuations for a large and growing portfolio of properties, focusing initially on single-family homes in the 16 central counties in North Carolina.

- 236 Million Valuations: Over time, Ariea’s AVM has produced more than 236 million individual property valuations, refining its algorithms and honing its accuracy.

- 0.4% Median Error Rate: One of the most compelling aspects of Ariea’s AVM is its 0.4% median error rate, an industry-leading figure that ensures property values closely match actual market conditions.

This accuracy is critical not just for the stability of ArieaCoin, but also for the broader implications of automated valuation models in real estate investing.

Ariea’s AVM closely follows the established principles of comparative market analysis, ensuring that each valuation is rooted in real-world data. The model uses the following steps:

1. Defining the Scope of Properties Evaluated: Ariea focuses on single-family residences, including detached houses, townhomes, and manufactured housing. The system excludes multi-family properties like duplexes and triplexes, as well as condominiums, as these property types have more complex valuation factors that are not currently included in Ariea’s model. By concentrating on single-family homes, Ariea ensures the consistency and accuracy of its valuations.

2. Establishing Geographic and Temporal Parameters: When evaluating a property, Ariea searches for comparable sales (comps) within a one-mile radius of the subject property and within a timeframe of up to one year. This ensures that the comps are geographically and temporally relevant, reflecting the current market conditions in the immediate area.

3. Filtering by Property Characteristics: Once comps are identified within the geographic and temporal constraints, Ariea filters them based on key property characteristics. Comps must be within plus or minus one bedroom, one bathroom, and 20% of the subject property’s square footage. This ensures that only properties with a similar size, layout, and set of features are used in the final analysis.

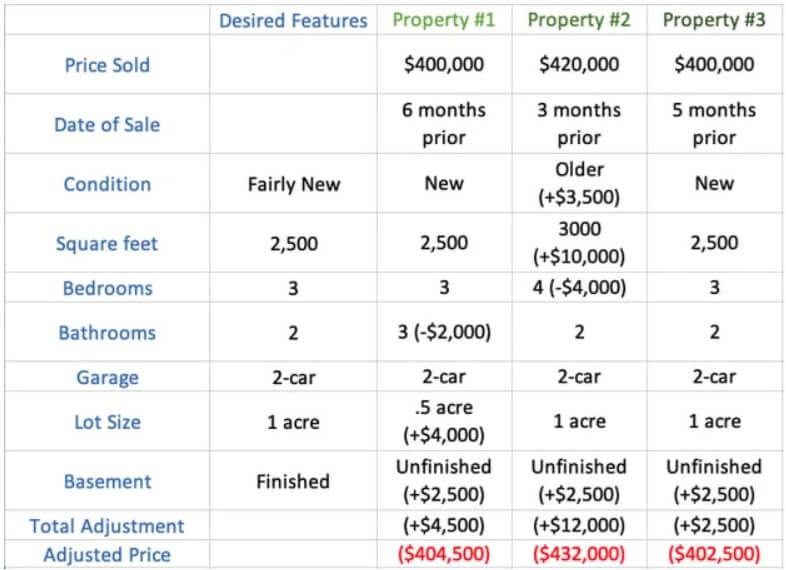

Just like a human appraiser, Ariea’s AVM must account for the differences between the subject property and its comps. For example, if a comp has an extra bedroom or a larger lot, the AVM makes adjustments to reflect how these features impact the property’s overall value.

This process is automated through Ariea’s home features index, a set of adjustments based on the historical performance of property sales in the area. By analyzing thousands of transactions, Ariea’s AVM can accurately determine the value of features like bedrooms, bathrooms, square footage, and garages.

- A 1,500-square-foot, 3-bedroom, 2-bath home sells for $250,000.

- A similar 1,500-square-foot home with 4 bedrooms sells for $275,000.

In this case, Ariea would assign a value of $25,000 to the additional bedroom. Similar adjustments are made for other property features, ensuring that the final valuation reflects the true market conditions.

Ariea’s AVM doesn’t stop at making simple adjustments. It applies a secondary round of filters to refine the comp pool further. Properties that require too many adjustments are discarded to ensure only the most relevant and comparable sales remain. Moreover, any properties with abnormal sales conditions—such as bankruptcy sales, foreclosures, or homes in significant disrepair—are filtered out to maintain accuracy. This serial filtering process ensures that Ariea’s AVM doesn’t rely on outlier data that could distort the final valuation. Once this process is complete, the AVM aggregates the adjusted values of the remaining comps to arrive at the subject property’s final valuation.

The success of ArieaCoin is directly tied to the accuracy of Ariea’s AVM, and with a 0.4% median error rate, the results speak for themselves. This level of precision ensures that ArieaCoin is a stable and reliable cryptocurrency, providing real estate investors and cryptocurrency enthusiasts with a secure asset that bridges the gap between two traditionally separate markets.

For real estate investors, ArieaCoin offers a new avenue for investing in real estate without the need to purchase entire properties. Instead, investors can own real estate-anchored assets through a secure, digital currency. This opens up opportunities for a broader range of investors to enter the real estate market, democratizing access to property investment.

Cryptocurrency investors, meanwhile, gain exposure to a digital currency that has inherent value, reducing the volatility often associated with speculative cryptocurrencies. ArieaCoin’s reliance on real estate-anchored valuations makes it a more stable asset, providing an additional layer of security for those looking to diversify their portfolios.

As the use of automated valuation models continues to grow in real estate and finance, ArieaCoin stands as a prime example of how technology can merge two worlds—real estate investment and cryptocurrency—into a single, innovative platform. Ariea’s performance metrics underscore its potential as a game-changing tool in the world of real estate investment.

In the coming years, Ariea plans to expand its coverage area, bringing its AVM to new markets across the United States. With each new market comes the potential for further refinement, increased accuracy, and more robust property data. For real estate brokers, appraisers, and investors, Ariea represents the future of how property values are calculated. For cryptocurrency enthusiasts, ArieaCoin is the bridge to a more stable and secure digital currency landscape.

ArieaCoin’s success is rooted in the precision and trustworthiness of Ariea’s Automated Valuation Model. With the ability to replicate the accuracy of traditional real estate appraisals while operating at a much larger scale, Ariea has set a new standard in real estate-backed cryptocurrencies. Its impressive performance metrics—236 million valuations and a 0.4% error rate—demonstrate the AVM's unparalleled accuracy. As a result, ArieaCoin stands at the intersection of real estate investment, automated valuation, and cryptocurrency, offering stability and transparency in an often-volatile industry.